The Expanding Triangle as a price pattern presents in all markets, time frames, & price ranges. Interestingly there is some debate concerning this pattern. Some technicians feel this pattern is: very rare, strictly a reversal, strictly a trend continuation. As the debate continues, their versatility has made Expanding Triangles available as either a bullish or bearish trend continuation pattern or a reversal pattern depending on the trading environment in the background & the pattern is not hard to find. Regardless of when they present Expanding Triangles can be a very powerful pattern.

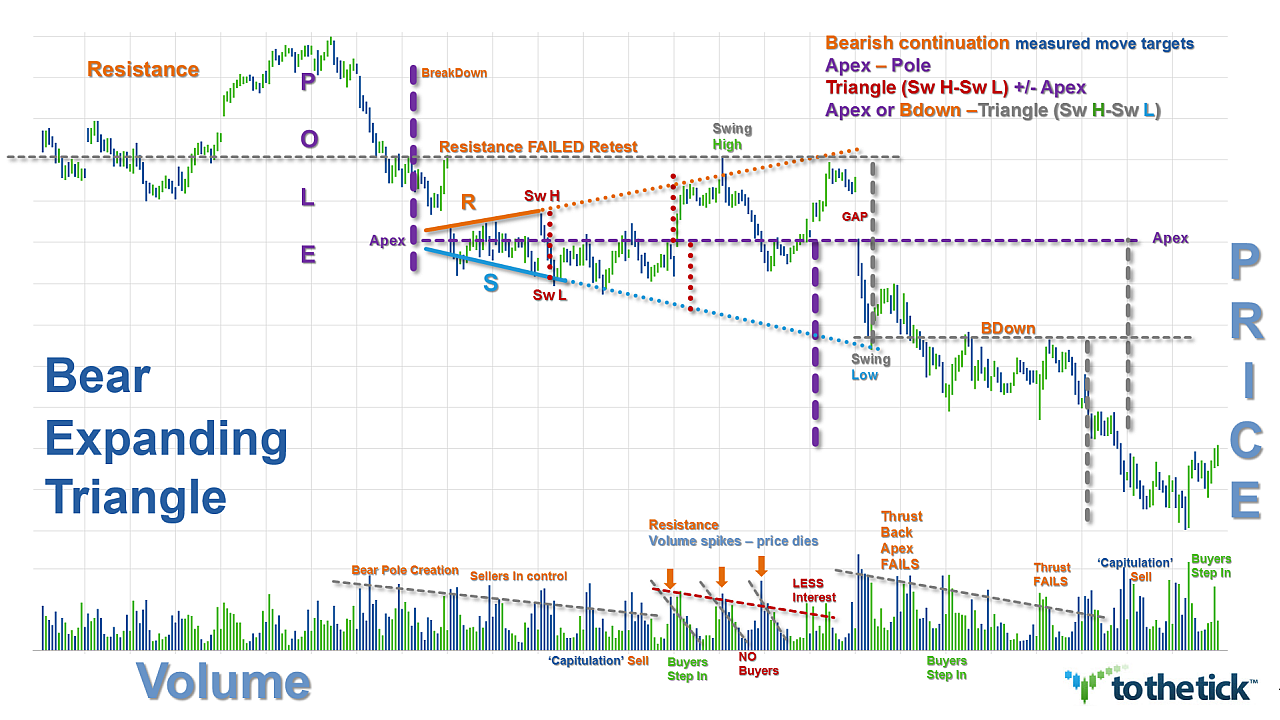

Visually the Expanding Triangle is characterized by a series of higher highs & lower lows regardless of when it presents. The shape of the Expanding Triangle is altered by the slope of the ascending resistance line & the slope of the descending support line which is ‘expanding’ or; inclining away from each other. The entire pattern can appear right-angled or tilted. The ‘tomahawk’ appearance of the Expanding Triangle is the mirror image or flipped in direction compared to the contracting symmetrical triangle. The Expanding Triangle pattern starts with the price action squeezed tightly in the Apex & as the pattern develops the price action swing high to swing low widens or spreads & therefore this pattern is also sometimes referred to as an ‘expanding apex’.

Expanding Triangles vary in their duration & are often quite large which offers nuances for traders during the development. They will have at least two swing highs & two swing lows in price. Traders should be prepared to adjust the trendlines as needed with additional swings. Overall volume usually diminishes as the pattern develops because traders become more & more unsure as to the market’s future direction. Eventually prices will break the immediate price range as outlined by the triangle extensions of support & resistance.

Traders can look to trade the Expanding Triangle in numerous similar methods regardless of market environment but with several nuances can ‘stack the deck’ which increases the risk-to-reward ratio for profits. The continuation pattern is one of the best performers statistically & the odds to trade an Expanding Triangle increase dramatically when traded with a controlling trend.

The bearish continuation pattern has 3 phases:

1) Background: A Strong impulsive, thrusting action with a surge in volume & price establishes a clear picture of the controlling bearish trend direction. In our expanding triangle price pattern it is represented visually by an up-side-down Pole, tip pointing down. Deeper and created with more drama the better as the Pole is the Key to recognizing the potential for the continuation of the pattern. The Pole represents trend direction as well as its strength & often this pattern is initiated as a new breakdown in price from an established bearish area.

2) The second phase is a pause for consolidation of the action both in volume & price and is represented by the expanding triangle. As traders we like to see this phase very short in duration with only 2 or 3 swings while our price action is range bound maintaining the higher highs & lower lows shape and the volume is ‘resting’. The best breakouts occur at 50-75% of the triangle completion. Typically this pattern will have several intermediate failed efforts to reach either the support or resistance as outlined by the triangle extensions. As with most patterns it benefits the trader to be aware of the ‘50-50’ or ‘muddy trench’ price area as outlined by the triangle apex. Traders should judge the risk:reward for entries based on the expectation with this pattern of the expansion of the price range with each subsequent swing in prices while zig-zagging through the apex line.

The pattern confirms as a bearish continuation pattern if the action creates a new bearish breakdown with a surge again from the bears in both volume & price. The immediate lower support outlined by the expanded triangle is the area traders look to see confirm the breakdown. Typically the action will mimic the volatility & energy experienced with the Pole creation. Since during formation the expanded triangle has offered an increasing price range it is highly recommended to pay close attention to the

1) volume after the breakdown as an aid in recognizing further potential for the pattern. With large patterns where the definition of immediate support & resistance has been ‘widened’ in price, re-tests of the apex &/or breakdown price are common before the trend can continue.

Options for Trading the Expanding Triangle as a bearish continuation pattern:

There are several methods of trading this pattern and it depends on your trading style.

Aggressive traders will enter short trades right around the resistance trendline once sufficient resistance has confirmed. The concept is that the trend is on your side and the bears are maintaining a lower level of resistance below the breakdown. Early entry opportunities will exist but remember the concept of the pattern…the definition of resistance will be higher in price with each subsequent swing so give yourself room for a reward. Traders should closely monitor the S&R lines to anticipate price swing extensions. Stop placement can be fairly tight right above entry & the recommendation with this pattern is to refer to a larger time frame for additional confirmation. After entry stops can be adjusted downward accordingly.

Note the ‘mid-line’ created using the apex as the measurement. Traders can gauge success of the immediate swing &/or base profit targets on this incremental value. When price approaches the previous triangle swing low price & then the lower support line extension, you should gauge the momentum: if you see that the momentum is strong stick to the position. However, if you see that support prevails, close the trade & take your profits to maximize the reward. The reaction seen in volume in these areas is key.

The aggressive trading method can highly increase the profit potential of any triangle, as you can trade the same pattern several times & profit from the ranging swing movements inside the pattern. However, remember that as a trend continuation pattern traders want this consolidation triangle formation to be relatively brief. Two or 3 swings may turn into more with this triangle but the 50-75% formation concept aids trade consideration.

Conservative traders will enter a trade once the lower support line has been broken &/or the new breakdown has confirmed. Often as with many patterns, it may take a 3rd effort.

(inside trader note: #1 3 efforts increases trader observance #2 better range in price opportunities both directions also means better risk:reward & #3 markets often 'move' in 3's.)False breakouts do happen and confirmation needed is always a traders’ choice. Several methods that apply here for either intrabar &/or close bar options offered in sequence: breakdown below support price, retrace holds new resistance line, price clears breakdown swing low price, larger chart combination.

Stop placement considerations can be aggressively lowered after the breakdown of the price.

Measured Move Targets based on structure of Pole & the Bear Expanding Triangle

Aggressive with Momentum & Volume: duplication of the original move or trader choice measurement of the Pole:

- Apex or BreakDown price (minus) Pole measure = target

- Pole measure = (Pole Base price (minus) Pole Tip price)

Aggressive with Momentum & Volume: swing action during formation of Triangle may offer several opportunities:

- Expanding Triangle measure (subtracted from) /OR (added to) Apex = target

- Expanding Triangle measure (subtracted from) BreakDown price = target

- Expanding Triangle measure = (swing high price of triangle (minus) swing low price of triangle)

- Note: Short entry option with trend bias but, long options may be available based on trader’s definition of ‘room’ using the Apex & S&R extensions as the guide

- Recommend considering coordination with larger time frame & consider...where is risk lower if able to use a tight stop worth the reward potential.

Conservative: waits for at least 3 clear efforts or swings to establish Resistance:

Targets are measured the same regardless of trader style.

Often the widest Swing High to Swing Low of the Expanding Triangle will be the largest measured move target.

- Expanding Triangle measure (subtracted from) Apex or wait for most aggressive option BD price = target

- Expanding Triangle measure = (swing high price of triangle (minus) swing low price of triangle)

Example Expanding Triangle as a bearish continuation pattern: