The Bull Pennant as a price action pattern typically presents immediately following an impulsive move in the market & represents a short consolidation before the continuation of the bullish trend. In general Pennants are found frequently in all markets, time frames, & price ranges. A fairly common price pattern that tends to provide a great risk:reward ratio when traded with a clear trend bias. They also tend to be easy to identify, very reliable and therefore, a trader favorite.

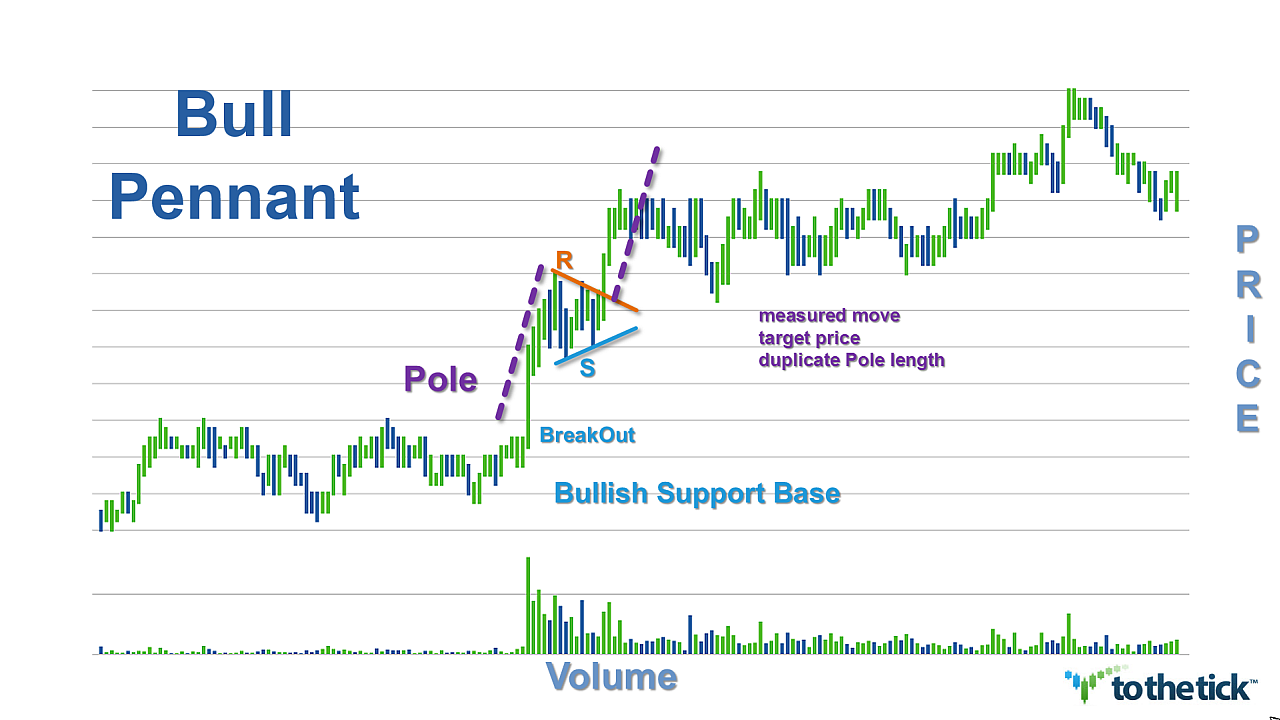

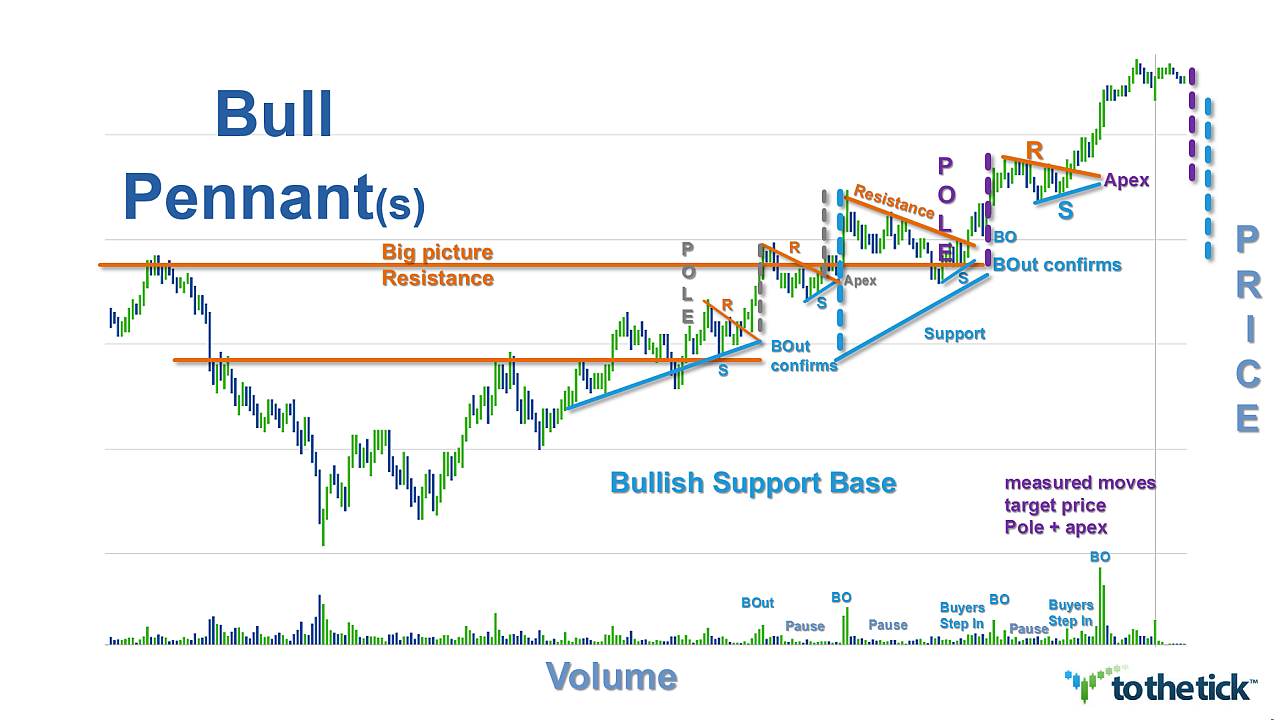

Visually Bull Pennants are a 2 part structure: a Pole with a base & a tip and then a pennant which looks very much like a small ‘stubby’ symmetrical triangle attached to the Pole and pointing to the right.

Bull Pennants are characterized with a series of higher lows & lower highs with trend lines drawn to represent the immediate support & resistance. The shape is altered by the slope of the descending resistance line & the slope of the ascending support line which is ‘converging’ or; inclining toward each other. The range-bound price action is balanced between buyers & sellers exhibiting similar strength/weakness & the pattern highlights this ‘mid-line’ price while squeezing to form an Apex.

The bullish continuation pattern has 3 phases:

1) Background: A Strong impulsive, thrusting action with a surge in volume & price establishes a clear picture of the controlling bullish trend direction. This action is represented visually by a Pole with tip pointing up. Higher & more drama the better as the Pole is the Key to recognizing the potential for the continuation of the pattern. The Pole represents trend direction as well as its strength & often this pattern is initiated as a new breakout in price from an established base of support & buyers are in control. This pattern has ‘1 rule: all Pennants must have a pole.’

2) The second phase is a pause for consolidation of the action both in volume & price and is represented by the Pennant. As traders we like to see this phase very short in duration with only 2 or 3 swings while our price action is range bound maintaining the higher lows & lower highs shape & the volume is ‘resting’.

- regardless of trend direction a Pennant will have higher lows & lower highs

- typically the difference between a Pennant & a Symmetrical Triangle is the size or duration of the consolidation phase. Pennants are usually shorter in duration & therefore ‘stubby’ in appearance.

3) The pattern confirms as a bullish continuation pattern if the action creates a new bullish breakout with a surge again from the bulls in both volume & price. The immediate upper resistance outlined by the Pennant is the area traders look to see confirm the breakout. Typically the action will mimic the volatility & energy experienced with the Pole creation.

Aggressive traders may trade long:

- failed swing low efforts on support once confirmed

- once the ‘mid-line’ price or Apex has broken out

- Traders can gauge success of the immediate swing based on this incremental value & when price approaches the upper resistance line should gauge the momentum.

- Stop placement can be fairly tight right below support & can be adjusted upward accordingly.

Conservative traders will enter a trade long:

- once the upper resistance line has been broken

- once the new breakout has confirmed

False breakouts do happen & confirmation needed is always a traders’ choice. Several methods that apply here for either intrabar &/or close bar options offered in sequence: breakout above resistance price, line holds retrace as new support, price clears breakout swing high price, price clears swing high of pennant/ Pole tip, or larger chart combination.

Stop placement considerations can be aggressively raised after the breakout of the price.

Measured Move Targets based on structure of Pole & the Bull Pennant

Aggressive with Momentum & Volume: duplication of the original move or trader choice measurement of the Pole:

- Pole measure (added to) Apex or BreakOut price = target

- Pole measure = (Pole Tip price (minus) Pole Base price)

Conservative &/or a first target:

- Pennant measure (added to) Apex or BreakOut price = target

- Pennant measure = (swing high price of pennant (minus) swing low price of pennant)

Example Bull Pennant as a bullish continuation pattern: