The Head & Shoulders Bottom (Inverted) is a powerful reversal price pattern seen in all markets, instruments, time frames, & price ranges. It presents with the immediate background environment as bearish with down-trending price action. The Head & Shoulders Bottom represents a basing period with multiple failed attempts by sellers to break through an area of support. This can be an indication that the established downtrend is losing strength & buyers may be gaining momentum. The Head & Shoulders Bottom usually marks an intermediate or long-term change in trend & is therefore considered to have a definite bullish bias.

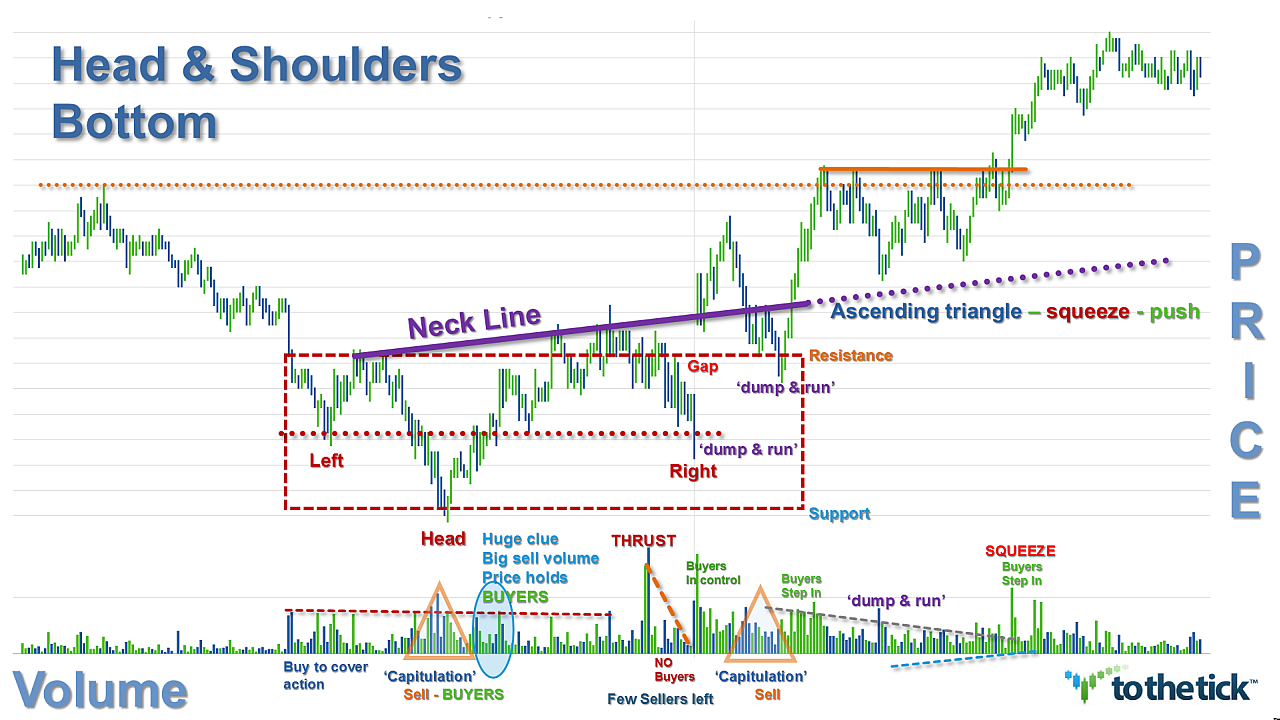

Visually the Head & Shoulders Bottom pattern resembles an up-side-down head with 2 shoulders. It presents with three consecutive lows in price, ‘valleys or troughs’ with the middle one being the deepest & the 2 outside ones being shallower & approximately equal. It also must have a moderate peak or swing high in-between each low. The price level of the highest swing high establishes what is called a ‘neckline’ & creates the immediate resistance for the pattern. Typically as this pattern develops overall volume levels usually decline. After a 3rd effort traders will look for an expansion of volume from the bulls to note conviction. The longer the pattern develops, the more significant the expected break.

There is a tendency for the Head & Shoulders Bottom to develop a high degree of symmetry but not always. Throughout development traders should be prepared for the pattern to possibly resemble a number of other patterns before the third bottom forms. The ‘spirit’ of the pattern highlights a battle between buyers & sellers & it may take some time & not look perfect. Ultimately the ‘final’ picture is not complete until a confirmed breakout has cleared resistance… The beauty of the Head & Shoulders Bottom pattern is the potential for multiple entries along the path once a trader can see the buyers in control. The final break of resistance &/or the angle of the neckline will often be a ‘trader nuance’ to determine. The inability to break support is bullish but the bulls have not won the battle until resistance has been broken.

Note that in the downtrend there may be many potential bottoms in price along the way down, but until significant resistance is broken, a reversal cannot be confirmed & traders should respect the trend.

Key points to formation in sequence:

- Background: price action trending Down

- 1st trough: marks lowest price point in the current trend

- 1st swing high effort: buyers step in & advance price typically to a significant price area also seen in the background downtrend action. This 1st effort establishes the immediate overhead resistance & defines a ‘neckline’.

- 2nd trough: the decline off the resistance usually occurs with lighter volume. Aggressive traders will look at volume activity for early signs of support from the bulls. No support on the previous swing low & a lower trough is now made. The time period between troughs can vary but typically they are in-line with the symmetry of the instrument of choice. Note that there is NO confirmation of a reversal of trend at this point.

- Advance from 2nd trough: Traders are looking for volume & buying pressure with the lack of sellers to accelerate off of the 2nd trough. The type of activity seen in volume during the effort back to resistance is an indication of strength or weakness. Note that often traders participate with this ‘lower low Double Bottom Pattern’ & watch prices run right back into resistance instead of getting a breakout. Or it is also quite common for prices to break through the 1st swing high price & establish a new higher high resistance line but then fail to advance much further. Therefore to be a Head & Shoulders Bottom the pattern must have a minimum of 3 swing low efforts creating support & 3 swing high efforts creating resistance. Keeping score on efforts made the swing count at this point in the pattern is ‘2 support - 2 resistance’.

- 3rd trough: the decline off the resistance usually occurs with even lighter volume. Support at the previous lows is the expectation & aggressive traders will look at volume activity for early signs from the bulls. Often this 3rd low price is in-line with the 1st swing low price of the pattern. Visually this price structure then resembles an up-side-down head with a left & now a right shoulder. How close to equal is close enough is a trader’s nuance to choose while remembering the ‘spirit’ of the pattern is the duel between buyers & sellers and to be used as a guideline. Volume ‘thrusts’ are common. The time period between troughs can vary but typically they are in-line with the symmetry of the instrument of choice. Note that there is NO confirmation of a reversal of trend at this point.

- Advance from 3rd trough: Traders are looking for volume & buying pressure with the lack of sellers to accelerate off of the 3rd trough. Surging volume is ideal; and again, the type of activity seen in volume during the effort back to resistance is an indication of strength or weakness & becomes more important with each subsequent effort. “Swing efforts now Count 3-3 & is the 3rd time a charm?”

- Resistance break: even after trading back up to resistance a trend reversal is not complete. Breaking thru resistance on this swing high price effort of the pattern & with conviction seen in volume completes the Head & Shoulders Bottom Reversal.

- Resistance turns into support: broken resistance becomes potential support. Often but not always, there is a test of this newly created support & this effort offers a final consideration for a long entry into a potential change of trend.

While this pattern is fairly straightforward it should be noted that traders often ‘jump the gun’. Not all repeated lows produce a change of trend & traders need to remember that the trend is in force until proven otherwise. Bottom formations can take some time and often it takes a break of a more significant resistance before a major change of trend. Patience is often a virtue. If a trader will give the pattern time to develop and look for the proper clues & then follow the guidelines, this chart pattern can be well-worth the effort of identifying & trading it.

Options for Trading the Head & Shoulders Bottom as a bullish reversal pattern:

There are 4 methods of trading this pattern & it depends on your trading style.

Most Aggressive traders will be looking for the 3rd trough in price as soon as the first 2 troughs show buyer support & the swing highs are in place. As the action comes back to re-test this low support area aggressive traders will be diligently monitoring the volume action looking for clues to the buying pressure. Entries in this area can work with a stop placement just below the lowest low of the formation. Aggressive traders should be prepared for capitulation selling or ‘dump & run’ type price action.

Aggressive traders may wait until a 3rd swing low is made & then monitor the action thru the middle of the reverse pattern. The concept of this option is to identify the reversal price action as being contained in a support/resistance ‘box’. Traders monitor the middle ‘muddy trench’ or 50-50 of the spread in price offered by the pattern for an entry once the bulls control. Stop placement can be fairly tight just below the trench zone. This can be an accurate trade looking to capitalize on a breakout & potentially a new bullish trend but without the risk of the most aggressive option.

Classic traders will look for a long entry with the breakout of the neckline or immediate pattern resistance. Stop placement right below the neckline price.

Conservative traders will watch the breakout & look for a re-test of that new breakout support price to hold for full confirmation of the Head & Shoulders Bottom reversal pattern. Stop placement right below breakout price. Note that this method of waiting for this pullback may or may not offer an opportunity but statistically it has a high % of success when it does present.

The aggressive trading methods can highly increase the profit potential of any Head & Shoulders Bottom & may offer more than one entry. However, the trader needs to assess whether the ‘extra’ profits choosing an earlier entry offers a decent risk:reward over waiting for some confirmation of action based on clearing a defined price resistance. Traders choosing these options should look for strength from buyers in combination with the lack of sellers. It cannot be stressed enough that volume is a major key & an expansion of bullish volume aids confirmation.

False breakouts do happen & confirmation needed is always a traders’ choice. Several methods that apply here for either intrabar &/or close bar options offered in sequence: breakout above resistance price, retrace holds new support line, price clears breakout swing high price, price clears next swing high of background downtrend price action, larger chart combination.

Stop placement considerations for all trade entry choices can be aggressively raised after the breakout of the price.

Measured Move Target based on structure of the Head & Shoulders Bottom Reversal Pattern

- Head & Shoulders Bottom Pattern measure (added to) BreakOut price = target

- Head & Shoulders Bottom Pattern measure = (swing high price of pattern (minus) swing low price of pattern)

Since the Head & Shoulders Bottom Reversal Pattern once confirmed has such a high degree of success indicating a change of trend, there are additional target considerations based on the knowledge that history repeats. All traders can look for tests on each of the swing highs seen in the immediate background downtrend price action. At any point & for all of these options, traders should gauge the continued conviction of the bulls based on momentum. If momentum is strong stick with the trade, if they get ‘lazy’ then consider taking profits & possibly look for a re-entry.

Examples: Head & Shoulders Bottom Reversal Pattern

This pattern created the change of trend & went on long for a lot of $.

Trader choice nuances for definition of resistance… red box, larger box, or neckline?

Notice the repeated ‘dump & run’ type of volume activity - repeated pattern in front of each push move.

This pattern went on long for a lot of $- see inset for set up inside background.

Trader choice nuances for definition of resistance…red box, orange or neckline?

Does the reverse box & muddy trench offer ‘insight’ to buyer/seller action?