The High &Tight Flag is a specialized bullish continuation price pattern.

Set up restrictions for the High & Tight means this trade does not happen often but when it presents… it offers a high reward to risk ratio. The pattern is seen as viable with any instrument and using any time frame.

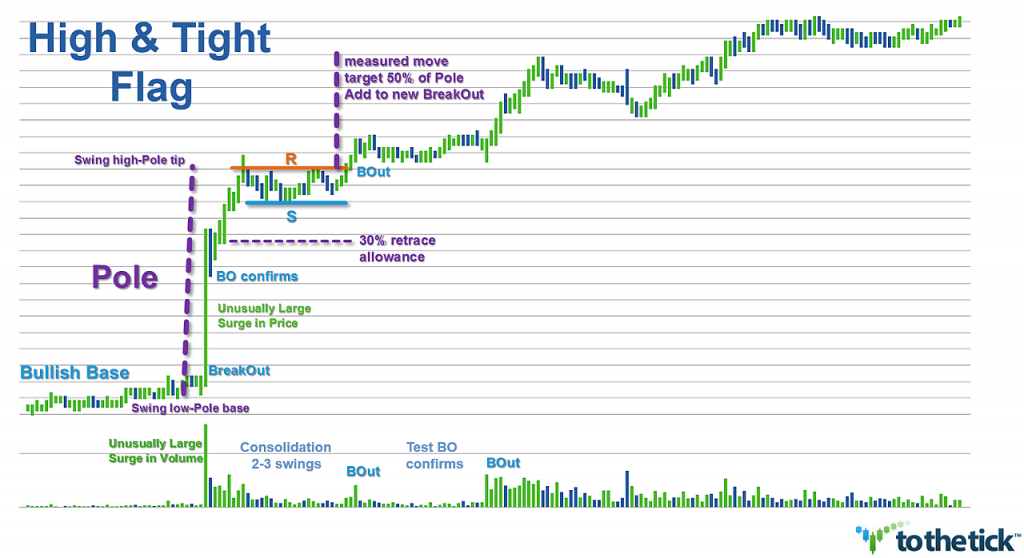

As with all Flags the High & Tight as a continuation price pattern has 3 recognizable sections to the formation: the impulse Pole, the consolidation Flag, and the follow-through or potential reward.

- The Pole of the High & Tight is the most noteworthy and easily recognizable condition for the pattern. The impulse move that creates the ‘Pole’ should be of an unusually large size in both volume and price action. It needs to be stressed that a trader should determine this definition to mean an aggressive, thrusting, larger than normal, surge in both price & volume happening in a relatively short period of time.

- Examples for 'unusually large' in both price & volume + time:

- $2 stock that has a breakout to $4 = a double in value with twice the normal daily average volume

- an index contract that breaks out in minutes with an advance twice the daily range in price with twice the usual volume

- please see the attached example of the pattern offered from a real scenario for further clarification

- The retrace consolidation or Flag portion is merely a brief pause, with a very ‘tight’ price structure and typically lower volatility as the bulls do not give much back from their aggressive gain. This consolidation in price & volume should look & feel like the bulls just need a 'pause or a breather'. While flags typically have a rectangular shape during this consolidation phase; it is important to note that, this specialized flag has no real restriction on ‘shape’. The real issue & concept here is the ‘Tight’ portion of the Flag needs to be seen with the bulls holding an aggressive new higher support line on price & totally maintaining control of the action.

- The follow-through comes with a new breakout of the immediate resistance and again should coincide with a new surge in both volume and price. This follow through confirms the bullish continuation pattern.

Structure of the pattern itself offers clear 'measured move' guidelines for traders.

- Measure the initial impulsive move in price that creates the Pole. Pole tip - Pole base (swing high to swing low) = Pole Measure

- Pole measure x 30-35% = maximum price retrace allowed for both stop placement & possible entry consideration area.

- Pole measure x 50% = potential target added to the new breakout price of the immediate resistance or Pole Tip (swing high)

- Note re-tests of this new breakout price are common & traders looking to maximize the potential need to continue to monitor the risk:reward. The definitive pattern is one where the bulls are obviously maintaining control advancing to new highs while maintaining higher lows.

Example High & Tight Flag: