The Triple Top is a reversal price pattern & while not as common as the smaller Double Top it is seen in all markets, instruments, time frames, & price ranges. It presents with the immediate background environment as bullish with up-trending price action. The price pattern represents multiple failed attempts by buyers to advance through an area of resistance and traders look for price to fall back down. The classic Triple Top can be an indication that the established uptrend is losing strength & sellers may be gaining momentum possibly creating the end of the advance in prices. The Triple Top Reversal usually marks an intermediate or long-term change in trend & is therefore considered to have a definite bearish bias.

Visually the Triple Top pattern presents three consecutive peaks in price, ‘highs’ that are roughly equal with the requirement of 2 moderate troughs or swing lows in-between. The price level of the lowest swing low establishes what is called a ‘neckline’ & creates the immediate support for the pattern. Typically as this pattern develops overall volume levels usually decline. After a 3rd effort traders will look for an expansion of volume from the bulls to note conviction. The longer the pattern develops, the more significant the expected break.

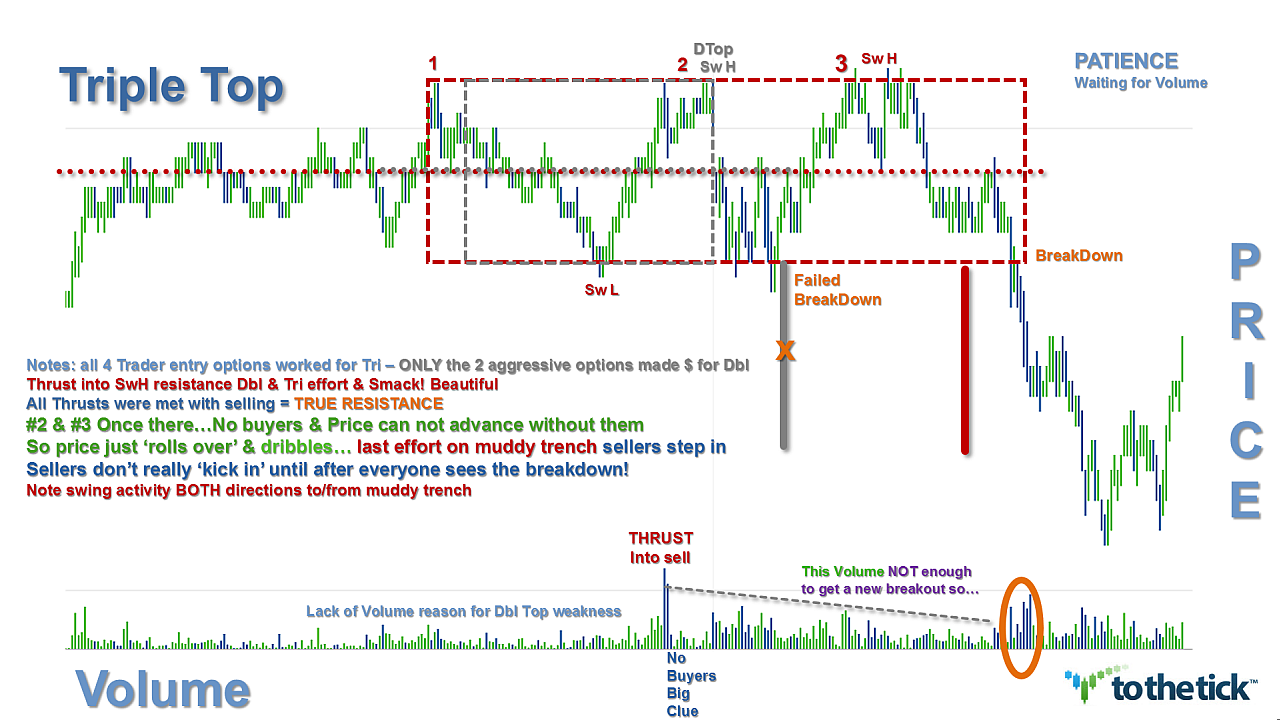

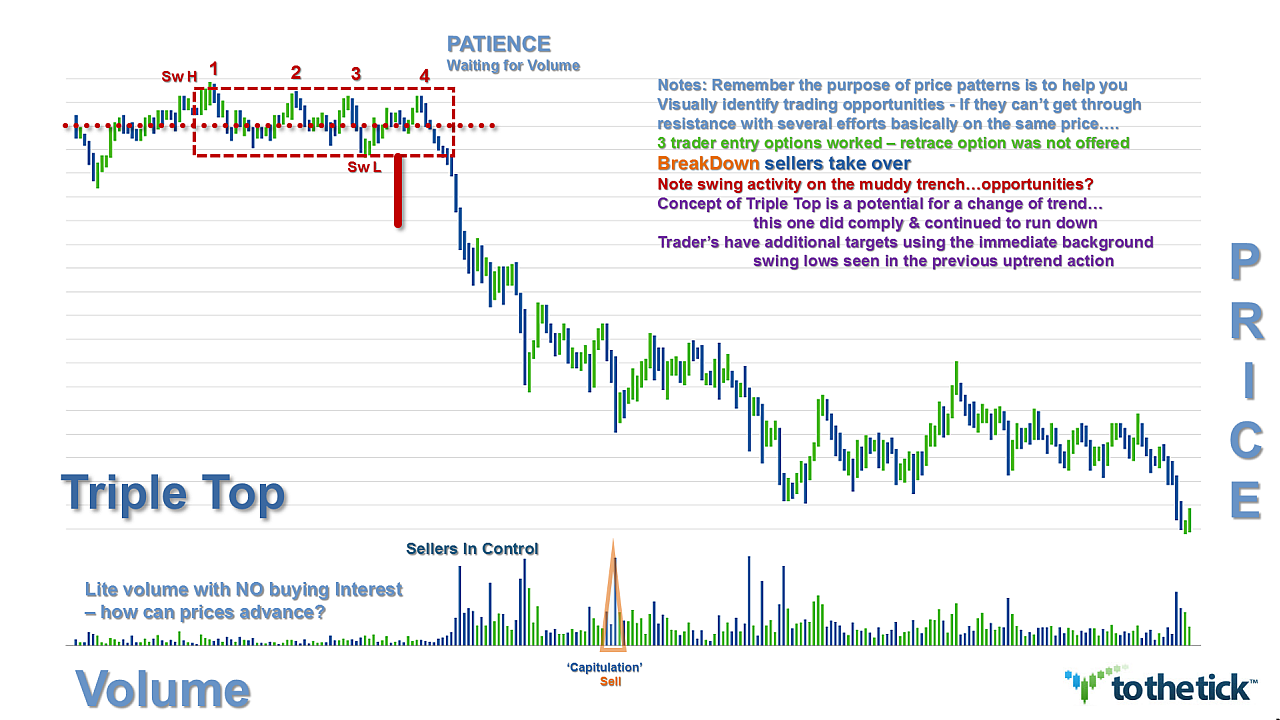

Throughout development of the Triple Top traders should be prepared for the pattern to possibly resemble a number of other patterns before the third Top forms. The ‘spirit’ of the pattern highlights a battle between buyers & sellers & it may take some time & not look perfect. Ultimately the ‘final’ picture is not complete until a confirmed breakdown has cleared support, regardless of the ‘shape’. The inability to hold support is bearish but the bears have not won the battle until support as confirmed as broken.

Note that in the uptrend there may be many potential Tops in price along the way up, but until significant support is broken, a reversal cannot be confirmed & traders should respect the trend.

Key points to formation:

- Background: price action trending Up

- 1st peak: marks highest price point in the current trend

- 1st swing low effort: sellers step in & retrace price typically to a significant price area also seen in the background uptrend action. This 1st effort establishes the immediate lower support & defines a ‘neckline’. Volume on the retrace is often large holders taking profits & may be inconsequential, but an increase could also signal early distribution.

- 2nd peak: the advance off the support usually occurs with lighter volume. Resistance at the previous high is the expectation & aggressive traders will look at volume activity for early signs from the bears. Note that there is NO confirmation of a reversal of trend at this point. The time period between peaks can vary but typically they are in-line with the symmetry of the instrument of choice. The 2nd high may offer a perfect double top in price but the ‘textbook’ range for price is acceptable within 3% of the 1st peak price.

- Retrace from 2nd peak: Traders are looking for volume & selling pressure with the lack of buyers to accelerate off of the 2nd peak. The type of activity seen in volume during the effort back to support is an indication of strength or weakness. Note that often traders participate with this Double Top Pattern & watch prices run right back into support instead of getting a breakdown. Or it is also quite common for prices to break through the 1st swing low price but then fail to decline much further. Therefore to be a Triple Top Reversal the pattern must have a minimum of 3 swing high efforts creating resistance & 3 swing low efforts creating support.

- 3rd peak: the advance off the support usually occurs with even lighter volume. Resistance at the previous highs is the expectation & aggressive traders will look at volume activity for early signs from the bears. Note that there is NO confirmation of a reversal of trend at this point. The time period between peaks can vary but typically they are in-line with the symmetry of the instrument of choice. Seldom is this 3rd high price exactly equal to the previous 2 swing highs of the pattern. How close is close enough is a trader’s nuance to choose while remembering the ‘spirit’ of the pattern as a guideline. Volume ‘thrusts’ are common.

- Decline from 3rd peak: Traders are looking for the lack of buying volume with increased selling pressure to accelerate off the 3rd peak. And again the type of activity seen in volume during the effort back to support is an indication of strength or weakness & becomes more important with each subsequent effort.

- Support break: even after trading back down to support a trend reversal is not complete. Breaking the support of the lowest swing low price effort of the pattern & with conviction seen in volume completes the Triple Top Reversal.

- Support turns into resistance: broken support becomes potential resistance. Often but not always, there is a test of this newly created resistance & this effort offers a final consideration for a short entry into a potential change of trend.

While this pattern is fairly straightforward it should be noted that traders often ‘jump the gun’. Not all repeated highs produce a change of trend & traders need to remember that the trend is in force until proven otherwise. Top reversal formations can take some time and patience is often a virtue. If a trader will give the pattern time to develop and look for the proper clues & then follow the guidelines, this chart pattern can be well-worth the effort of identifying & trading it.

Options for Trading the Triple Top as a bearish reversal pattern:

There are 4 methods of trading this pattern & it depends on your trading style.

Most Aggressive traders will be looking for the 3rd peak in price as soon as the first 2 peaks show resistance & the swing lows are in place. As the action comes back to re-test this high resistance area aggressive traders will be diligently monitoring the volume action looking for clues to the lack of buying & increased selling pressure. Entries in this area can work with a stop placement just above the highest high of the formation. Aggressive traders should be prepared for ‘thrust’ type price action.

Aggressive traders may wait until a 3rd swing high is made & then monitor the action thru the middle of the reverse pattern. The concept of this option is to identify the reversal price action as being contained in a resistance/support ‘box’. Traders monitor the middle ‘muddy trench’ or 50-50 of the spread in price offered by the pattern for an entry once the bears control. Stop placement can be fairly tight just above the trench zone. An additional option to add to this set up is to include waiting for 3 solid efforts on support & then consider the muddy trench zone entry. This can be an accurate trade offering an entry looking to capitalize on a breakdown & potentially a new bearish trend but without the risk of the most aggressive option.

Classic traders will look for a long entry with the breakdown of the neckline or immediate pattern support. Stop placement right above the neckline price.

Conservative traders will watch the breakdown & look for a re-test of that new breakdown resistance price to hold for full confirmation of the Triple Top reversal pattern. Stop placement right above breakdown price. Note that this method of waiting for this pullback may or may not offer an opportunity but statistically it has a high % of success when it does present.

The aggressive trading methods can highly increase the profit potential of any Triple Top & may offer more than one entry. However, the trader needs to assess whether the ‘extra’ profits choosing an earlier entry offers a decent risk:reward over waiting for some confirmation of action based on clearing a defined price support. Traders choosing these options should look for strength from sellers in combination with the lack of buyers. It cannot be stressed enough that volume is a major key & an expansion of bearish volume aids confirmation.

False breakdowns do happen & confirmation needed is always a traders’ choice. Several methods that apply here for either intrabar &/or close bar options offered in sequence: breakdown below support price, retrace holds new resistance line, price clears breakdown swing low price, price clears next swing low of background uptrend price action, larger chart combination.

Stop placement considerations for all trade entry choices can be aggressively lowered after the breakdown of the price.

Measured Move Target based on structure of the Triple Top Reversal Pattern

- Triple Top Pattern measure (subtracted from) BreakDown price = target

- Triple Top Pattern measure = (swing high price of pattern (minus) swing low price of pattern)

Since the Triple Top Reversal Pattern once confirmed has such a high degree of success indicating a change of trend, there are additional target considerations based on the knowledge that history repeats. All traders can look for tests on each of the swing lows seen in the immediate background uptrend price action. At any point & for all of these options, traders should gauge the continued conviction of the bears based on momentum. If momentum is strong stick with the trade, if they get ‘lazy’ then consider taking profits & possibly look for a re-entry.

Examples: Triple Top Reversal Pattern